SOL Price Prediction: Can Solana Break $500 in 2025?

#SOL

- Technical Outlook: SOL shows mixed signals with MACD bullishness countering MA resistance.

- Market Sentiment: Strong institutional interest and ecosystem growth support $200+ targets.

- Price Catalysts: Seeker Phone launch and AI predictions may drive FOMO above $171 resistance.

SOL Price Prediction

SOL Technical Analysis: Key Indicators and Future Trends

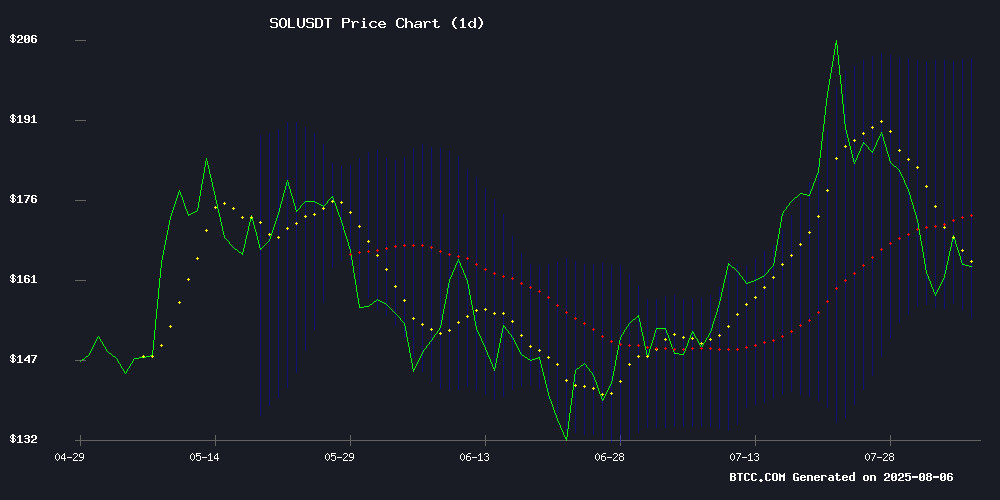

According to BTCC financial analyst James, SOL is currently trading at $168.40, below its 20-day moving average (MA) of $178.47, indicating a short-term bearish trend. The MACD (12,26,9) shows a positive histogram at 11.1303, suggesting potential upward momentum despite recent resistance. Bollinger Bands reveal SOL is NEAR the lower band ($154.88), which could act as a support level. James notes that a break above the middle band ($178.47) may signal a bullish reversal.

Market Sentiment: Bullish Catalysts for SOL

BTCC financial analyst James highlights several bullish developments for solana (SOL). The upcoming Seeker Phone aims to improve usability, while Claude AI predicts SOL could surpass $500 sooner than expected. Institutional accumulation during the market dip and a $200 price target further bolster optimism. Additionally, Phantom's acquisition of Solsniper and Jupiter's decentralized lending platform launch enhance Solana's ecosystem. However, resistance at $171 remains a near-term hurdle.

Factors Influencing SOL’s Price

Solana’s Seeker Phone Aims to Fix Saga’s Flaws With Usability Upgrade

Solana Mobile's Seeker phone, priced at $500, is designed for active Solana users who transact on-chain frequently. With 150,000 pre-orders from over 50 countries, the device focuses on crypto-first functionality, offering a lighter design and longer battery life than its predecessor, the Saga.

The Seeker addresses criticisms of the Saga, which prioritized security at the expense of usability. 'If you transact at least once a week, Seeker makes sense,' said Emmett Hollyer, Solana Mobile's general manager. The phone is not intended for casual crypto users but targets those deeply embedded in the Solana ecosystem.

Claude AI Predicts Solana Breaking $500 Sooner Than Expected with 2025 Targets

Solana's 2025 performance reveals a striking disconnect between network fundamentals and price action. While processing hundreds of millions of daily transactions with 99.99% uptime, SOL remains range-bound between $164-$168 in August, capped by a persistent $180-$188 resistance level. The market appears to undervalue Solana's execution as developer adoption scales and real economic activity migrates on-chain.

Technical indicators paint a neutral picture with RSI at 40-45 and MACD leaning bearish, yet price holds firmly above the $162 200-day moving average. Spot volumes in the billions and surging futures activity suggest accumulation during consolidation. A decisive break above $188 with volume could propel SOL toward $200-$206 near-term, with significantly higher targets in play for 2025.

Network metrics continue to impress—throughput, stability, and growing DeFi market share—as institutional infrastructure develops. Custody solutions, liquidity pools, and potential ETF access are coming into focus, creating catalysts for revaluation. The path forward appears straightforward: market recognition of Solana's technical leadership may soon close the gap between utility and valuation.

Whales and Institutions Accumulate Solana Amid Market Dip, $200 Target in Sight

Solana's price action remains volatile, retreating from its recent peak above $180 despite growing institutional interest. On-chain data reveals persistent accumulation by whales, with one entity moving $12 million worth of SOL through Binance to stake on Kamino Finance.

Corporate treasuries are joining the fray. Upexi now holds over 2 million SOL ($334 million) after a 170% expansion of its position since July. The network's validator ecosystem continues attracting institutional participants, with total holdings surpassing $568 million.

Market observers point to these developments as evidence of structural demand. The $200 psychological barrier appears increasingly viable as staking activity and balance sheet allocations demonstrate long-term conviction in Solana's infrastructure.

LetsExchange Lists xStocks, Bridging Traditional Equity and Crypto Markets

LetsExchange has integrated xStocks, tokenized versions of major equities and ETFs, enabling crypto traders to access traditional markets around the clock. Built on Solana, these assets offer blockchain efficiency—fast settlements, fractional ownership, and transparency verified by Chainlink's Proof-of-Reserve.

The move reflects accelerating institutional interest in asset tokenization. Backed by Swiss-regulated entity Backed Assets, xStocks track giants like Google and Nvidia 1:1, with underlying shares held in custody. Kraken, Bybit, and KuCoin previously adopted the product, signaling growing demand for hybrid financial instruments.

For crypto-native investors, this eliminates traditional market hurdles: geographic restrictions, limited trading hours, and custodial delays. LetsExchange's implementation emphasizes non-custodial trading—a strategic differentiation in an industry increasingly focused on self-sovereignty.

gTrade Launches v10 Upgrade with Funding Fee Model and Expanded Markets

Decentralized perpetuals exchange gTrade has rolled out its most significant upgrade to date, version 10 (v10), introducing a funding fee model that replaces the previous borrowing fee structure. The shift aims to enhance scalability, reduce open interest constraints, and cater to advanced trading strategies like swing trading, arbitrage, and hedging.

Founder Seb emphasized the upgrade's focus on precision and transparency, now accessible to a broader range of traders, integrators, and funding fee farmers. The platform has expanded its synthetic exposure to include traditional assets such as equities, indices, forex, and commodities, alongside over 240 cryptocurrencies.

Integration partners like Bifrost, Volmex Finance, and Symphony.io can now leverage higher open interest limits and capital-efficient mechanisms for cross-market strategies. To celebrate the launch, gTrade is hosting a $200,000 trading competition in August across Arbitrum, Base, Solana, and Polygon.

Phantom Expands Solana Trading Capabilities with Solsniper Acquisition

Phantom, the dominant wallet in the Solana ecosystem, has acquired Solsniper—a leading trading tool known for its speed and precision in tracking meme coins and rapid market movements. The move signals Phantom's ambition to evolve beyond basic wallet services into a comprehensive trading platform.

The acquisition follows Phantom's $150 million Series C funding round, led by Sequoia Capital and Paradigm, which valued the company at $3 billion. Earlier this year, Phantom also integrated SimpleHash, an NFT metadata provider, underscoring its strategic push into analytics and trading infrastructure.

Solana's meme coin market has surged in 2025, fueled by platforms like Pump.fun, which recorded $3 billion in daily volume at its peak. Solsniper's sniping tools, enabling instant token purchases post-launch, have become indispensable for traders capitalizing on this volatility. Phantom confirmed Solsniper will operate independently for now, though integration plans loom.

Solana Faces Resistance at $171 as Bullish Momentum Wanes

Solana (SOL) encountered stiff resistance near $171, retreating to $163.98 after a brief intraday rally failed to sustain momentum. Trading volume surged 23% to $5.39 billion, revealing active participation but insufficient buying pressure to overcome key technical barriers.

The rejection mirrors SOL's struggle to breach the $210-$220 zone since early 2024. December's fleeting rally above $300 now appears anomalous as the asset consolidates within a narrowing range. Technical indicators flash warning signs - RSI and MACD divergences suggest weakening upward thrust.

Trader Misses $36 Million Windfall After Premature Sale of SOL-Based TROLL Meme Coin

Leland King Fawcette's $1,300 sale of TROLL tokens in August 2024 became a cautionary tale when the Solana meme coin later surged to a $158 million market cap. Had he held, his position would have ballooned to $36 million. The token languished for months before an April 2025 rally propelled it to prominence.

Created on Pump.fun—Solana's meme coin launchpad—TROLL initially showed no activity after Fawcette's influencer promotion attempts failed. Its meteoric rise underscores the volatility and unpredictability of meme coin markets, where patience often separates monumental gains from missed opportunities.

Jupiter Launches Private Beta for Decentralized Lending Platform on Solana

Jupiter has initiated the private beta phase of Jupiter Lend, its highly anticipated decentralized lending platform built on the Solana blockchain. The rollout, which began on August 6, is currently accessible only to users who secured early access via the waitlist. A full public launch is slated for later this month.

The platform promises capital efficiency with a 95% loan-to-value ratio—significantly higher than the industry standard of 75%—and near-zero liquidation penalties. Developed in collaboration with Fluid, Jupiter Lend aims to redefine DeFi lending with isolated risk vaults and simplified yield mechanisms.

Incentives from over 10 partners are expected upon public release, positioning Jupiter Lend as a potential market leader in Solana's evolving DeFi landscape.

How High Will SOL Price Go?

BTCC analyst James projects SOL could reach $200 in the near term, with a longer-term target of $500 if bullish catalysts materialize. Key technical levels to watch include:

| Indicator | Value | Implication |

|---|---|---|

| 20-day MA | $178.47 | Breakout target |

| Bollinger Upper Band | $202.06 | Resistance zone |

| MACD Histogram | +11.13 | Bullish momentum |

News-driven demand from whales and ecosystem upgrades could accelerate gains.